Urgent Editor's Note:

Corporate America Reshoring

In a stunning display of economic nationalism, two of America's most critical technology companies have just committed nearly $800 billion to domestic manufacturing and production over the next four years. This could potentially represent one of the largest corporate reshoring movements in U.S. history, potentially reshaping global supply chains and creating significant opportunities for American investors who understand the political and economic forces at play.

Based on these events, one of our 'Trusted Partners' just launched a Must-See presentation below.

Trusted Partner Presentation

If you thought the trade war was over…

Think again.

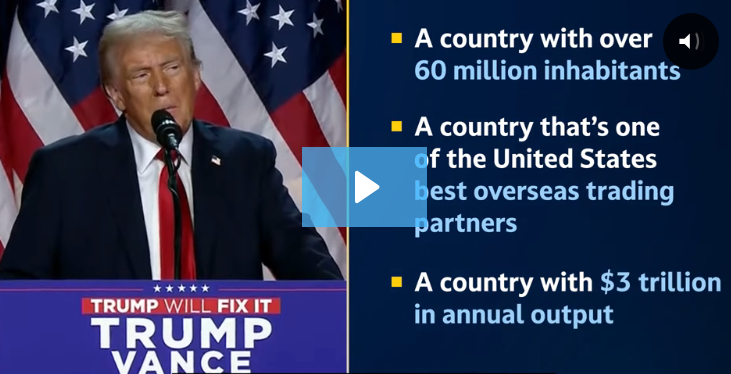

It looks like Trump is about to drop his final economic superweapon.

It's got nothing to do with tariffs…

But it could cause a $12 trillion market megashift…

And those who are positioned in time could pocket once-in-a-lifetime gains.

Click here to see the full story.

The Trump administration's America First agenda appears to be delivering tangible results as major technology companies race to bring production back to American soil. Within just days of each other, memory chip giant Micron Technology reported record-breaking earnings driven by artificial intelligence demand while committing $200 billion to U.S. manufacturing, and Apple announced a historic $600 billion domestic investment following a high-profile White House meeting. These developments may signal a fundamental shift in how American corporations view domestic production, driven by both political pressure and what analysts believe are unprecedented market opportunities in the AI revolution.

$800B

Combined domestic investment commitments from Micron and Apple over next four years

Memory Chip Supercycle Fuels Micron's Record Performance

Micron Technology delivered explosive third-quarter results that exceeded expectations, posting record revenue of $9.30 billion compared to the $8.86 billion analysts predicted. The 37% year-over-year growth was driven primarily by surging demand for high-bandwidth memory (HBM) chips, the specialized components that power artificial intelligence systems. The company's earnings per share of $1.91 represented a 208% increase from the previous year, as HBM revenue grew 50% sequentially and now represents what the company describes as a $6 billion annual run rate.

"The political timing couldn't be more significant. Micron's announcement of a $200 billion U.S. manufacturing investment over the next two decades directly aligns with the Trump administration's push for semiconductor independence from China and other foreign suppliers."

$9.30B

Micron's record Q3 revenue driven by AI chip demand, exceeding analyst expectations

Apple's White House Gambit Pays Off with $600 Billion Commitment

Apple CEO Tim Cook's August 6th visit to the White House resulted in one of the most significant corporate investment announcements in American history. Standing alongside President Trump in the Oval Office, Cook revealed that Apple would increase its U.S. investment commitment to $600 billion over four years, adding $100 billion to the company's previous pledge. The announcement helped trigger what analysts called Apple's best weekly performance since July 2020, with shares surging approximately 13% and adding an estimated $400 billion to the company's market capitalization.

Based on these events, one of our 'Trusted Partners' just launched a Must-See presentation below.

✓ Trusted Partner Presentation

It's wildly profitable - Over $3 billion in operating income. It has a partnership with the hottest AI stock on Wall Street.

And Trump has publicly backed it?

13% Surge

Apple's weekly stock performance following White House meeting and investment announcement

Political Capital Drives Supply Chain Revolution

The convergence of these announcements reflects what analysts believe could be a broader transformation in corporate America's approach to manufacturing and supply chain management. Both companies appear to be leveraging political relationships and policy alignment to secure potential competitive advantages while addressing legitimate national security concerns about foreign dependency in critical technologies. Micron's focus on memory chips and Apple's emphasis on semiconductor assembly could create complementary domestic capabilities that may strengthen America's position in the global technology race.

The Trump administration's willingness to use tariffs and other trade tools as leverage appears to have influenced corporate decision-making. Apple's commitment could potentially shield the company from semiconductor tariffs that might have added significant costs to iPhone production, while Micron's domestic expansion may position the company to benefit from any potential restrictions on foreign memory chip imports.

What This Could Mean for Investors

These developments may represent more than typical corporate earnings beats or investment announcements – they could signal a fundamental shift toward economic nationalism that might reshape entire industries. Micron's stock has gained approximately 12% since its earnings announcement, trading around $124.52 as of recent sessions, while Apple closed Friday at $229.35 after its notable weekly surge. The companies' combined market capitalization of over $4 trillion now includes nearly $800 billion in committed domestic investment, potentially creating alignment between shareholder value and American economic interests.

The timing suggests this trend may be just beginning. As more companies could face pressure to demonstrate domestic commitment while capitalizing on AI-driven demand, investors might witness what some analysts believe could be among the largest reshoring movements in modern American history. The potential sustainability of these commitments, regardless of future election outcomes, may benefit from apparent bipartisan support for reducing foreign technology dependence and the potential economic benefits of domestic high-tech manufacturing.

Before You Go...You Need To See This

Trusted Partner Presentation

Trump's Next Big Market Shake-up

Why Is Trump Fast-Tracking These 3 Stocks?

Forget AI — a new wave is hitting Wall Street.

And it's being driven by none other than President Trump.

His administration has begun fast-tracking a select group of companies, potentially accelerating their profits — and their stock prices.

Now, legendary investor Louis Navellier says this trend is just getting started...

And he's zeroing in on three stocks poised to benefit most.

Click here to see his full breakdown

You don't want to miss what could be Trump's next big market shake-up.