Urgent Editor's Note:

Market Analysis

The administration's tariff enforcement has created immediate market disruptions across traditional and digital assets, with institutional positioning suggesting significant shifts ahead. Smart money appears to be repositioning for prolonged policy uncertainty, potentially favoring domestic-focused strategies.

Based on these events, one of our 'Trusted Partners' just launched a Must-See presentation below.

Trusted Partner Presentation

If you thought the trade war was over…

Think again.

It looks like Trump is about to drop his final economic superweapon.

It's got nothing to do with tariffs…

But it could cause a $12 trillion market megashift…

And those who are positioned in time could pocket once-in-a-lifetime gains.

Click here to see the full story.

President Trump's August 1 tariff implementation sent shockwaves through global markets Friday, with Bitcoin (BTC) crashing below $112,000 and triggering over $1 billion in leveraged position liquidations. The S&P 500 (SPY) fell 1.6% while cryptocurrency markets posted their worst day since May, as the administration's 15% baseline tariff on EU goods and 35% rate on Canadian imports drove risk-off sentiment worldwide.

$1B+

Bitcoin liquidations triggered as crypto markets crash on tariff implementation news

Policy Shock Creates Market Disruption

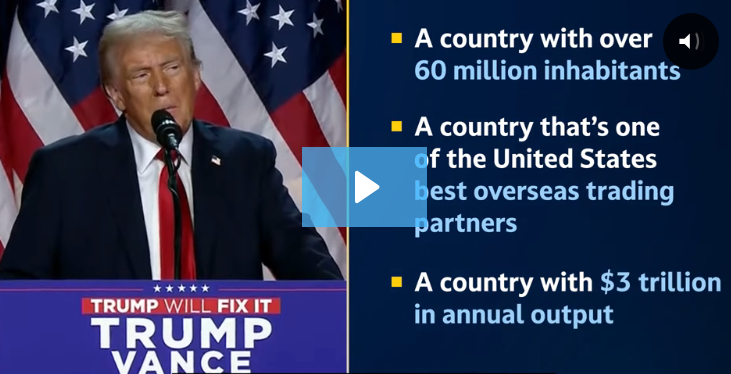

The tariff implementation, which affects virtually every major trading partner except China and the UK, caught markets off-guard despite months of warnings. Bitcoin's 3% decline to $113,231 triggered massive liquidations as overleveraged positions unwound rapidly. Traditional markets followed suit, with small-cap stocks (IWM) underperforming as import-dependent businesses faced immediate cost pressures.

"Markets are rattled by the comprehensive nature of these tariffs, affecting virtually every trading relationship and creating uncertainty about future policy direction."

15% EU Rate

New baseline tariff on European Union goods creates immediate cost pressures for importers

Dollar Strengthens Amid Flight to Safety

The U.S. Dollar Index (DXY) surged as investors sought safety, while emerging market ETFs like Brazil (EWZ) and China (FXI) posted significant declines. This policy-driven dollar strength could benefit domestic-focused companies while pressuring international revenue streams for multinational corporations.

Based on these events, one of our 'Trusted Partners' just launched a Must-See presentation below.

✓ Trusted Partner Presentation

It's wildly profitable - Over $3 billion in operating income. It has a partnership with the hottest AI stock on Wall Street.

And Trump has publicly backed it?

35% Canada

Tariff rate on Canadian goods takes effect immediately, creating trade flow disruption

The comprehensive nature of these tariffs marks a significant escalation in trade policy, affecting import costs across multiple sectors. Technical indicators suggest continued volatility as markets digest the full implications of this policy shift, with domestic-focused companies potentially benefiting from reduced foreign competition.

What This Could Mean for Smart Investors

Institutional positioning suggests this tariff implementation marks a fundamental shift toward protectionist policies that could persist. Investors may want to monitor domestically-focused small caps and dollar-sensitive sectors for potential opportunities. The timing may be important for portfolio allocation, as policy uncertainty could shift market dynamics toward companies with strong domestic exposure and pricing power over the coming quarters.

Before You Go...You Need To See This

Trusted Partner Presentation

Trump's Next Big Market Shake-up

Why Is Trump Fast-Tracking These 3 Stocks?

Forget AI — a new wave is hitting Wall Street.

And it's being driven by none other than President Trump.

His administration has begun fast-tracking a select group of companies, potentially accelerating their profits — and their stock prices.

Now, legendary investor Louis Navellier says this trend is just getting started...

And he's zeroing in on three stocks poised to benefit most.

Click here to see his full breakdown

You don't want to miss what could be Trump's next big market shake-up.